PP: Expedia Deep Dive & COVID Rescue Financing

Sometimes restructuring transactions actually work and save the day!

Welcome to the 97th Pari Passu Newsletter,

After last week’s detour from the restructuring world with our Nuclear Deep Dive, we are back to our loved world of restructuring to explore a story that showed everyone that all we do is not just “Kicking the can down the road”.

In 1996, Bill Gates announced a humble new web product: Microsoft Expedia. A union between “Exploration” and “Speed,” Expedia was intended as another product to use the fledgling internet to solve real consumer needs. While Microsoft believed it would “reshape the way consumers plan and purchase their travel” by turning the screen around from the traditional travel agent into the hands of the traveler, few could have predicted the growth of Expedia into the industry giant it is today. This article explores Expedia’s truly unique journey. From becoming a public company, growing aggressively through serial M&A, surviving COVID with the help of rescue financing, to navigating recent industry paradigm shifts, Expedia has traveled quite a distance.

Curious how the world’s best investors are using AI

Hebbia works with lean leading equity, credit and restructuring shops.

Hebbia can summarize a credit agreement, draft one-pagers based on your team’s investment philosophy and so much more.

Book a 20 minute demo to see why they work with 1/3 of the 25 largest alternative asset managers.

Origins

In 1994, Richard Barton (who later founded Zillow and Glassdoor), worked in Microsoft’s CD-ROM division. While he was tasked with building travel guidebooks and putting them on disks, he recognized the CD-ROM industry was in decline and transferred over to the Multimedia division. In this new role, he came up with the idea of selling travel online, which he successfully pitched to Bill Gates at the company’s annual product review. At first, Expedia began as a simple website hosted on MSN. It only allowed consumers to make purchases, which were limited to air, car, and hotel reservations. At the time, most consumers only used the internet to browse information, and it was unclear whether they would trust Expedia with large travel purchases. In fact, in response to the launch, the American Society of Travel Agents claimed it would remain a niche offering forever: “There may be a small percentage of do-it-yourselfers who want to book electronically, but most people think their time is too valuable” [1, 2, 3].

Expedia quickly began to prove the doubters wrong. By March 1997, only a few months after its inception, the company reported that it had booked $1mm worth of travel reservations in a seven-day period. In 1998, Microsoft launched the Expedia Associates Program, which enabled suppliers and other companies to use Expedia’s booking engine to set up co-branding websites. In the first year of the Expedia Associates Program, several large travel companies including American Express Vacations, National Rental Car, and Hotel Reservations Network joined the program. These early successes gave credence to Expedia’s vision of a mutually beneficial two-sided marketplace [1, 3].

By mid-1999, Expedia had expanded into the United Kingdom, Germany, Canada, and Australia, and was predicted to be one of the ten largest travel agencies by the end of the year. Taking advantage of this momentum and the exuberance of the dot-com boom, Microsoft decided to float a small piece of Expedia in an IPO in September 1999. While this was the first time Microsoft had spun off one of its businesses, the IPO was a roaring success, with shares closing more than triple the IPO price on the first day trading on the NASDAQ. While the company had never generated a profit, quarterly revenue stood at $15mm and was quickly growing, with over $750mm in total booking value predicted in 1999 [1, 4].

By 2000, the attractiveness of the industry led to the growth of several prominent competitors. One of these competitors was Priceline.com, which sued Expedia, claiming that Expedia’s price matcher service infringed on its patent. A greater threat to Expedia, however, was Travelocity: both companies were locked in an intense battle to be the number one online travel service provider. To improve its position, Travelocity launched a strategic partnership with Priceline.com, and it acquired another rival, Preview Travel. In response, Expedia engaged in its own deals in order to “firmly establish itself as the leader in internet lodging.” In 2000, the company bought market share through the successful acquisitions of Travelscape.com and VacationSpot.com for $95mm and $82mm in stock, respectively. Additionally, Expedia raised money to continue to fund operations through a PIPE financed by Microsoft and Technology Crossover Ventures (TCV), [1, 5, 6].

With the Priceline.com lawsuit settled in 2001, which allowed Expedia to continue to use its price match feature in return for royalty payments, the company looked to continue its explosive growth, with a focus on not only hotels but also broader lodging. The company first achieved profitability in Q3 2001, earlier than a mid-2002 target. The next year, Expedia entered the corporate travel market through the acquisition of the agency Metropolitan Travel [7, 8].

Despite this growth, then-CEO of Microsoft, Steve Balmer, wanted to refocus Microsoft on the creation of software, over the development of other businesses deemed “distractions.” As part of this initiative, in 2001 Microsoft divested its 75% controlling stake in Expedia to USA Networks, a media holding company led by media legend Barry Diller. The transaction was financed via stock and other securities, and was valued at between $1.23n to $1.5bn. The acquisition made sense according to analysts, who predicted that Expedia would benefit from the distribution capabilities of USA Networks, which owned various media assets, including several TV channels, while USA Networks would see an opportunity for direct travel sales in the media [9, 10].

Following its shift into internet assets and away from traditional media, USA Networks was renamed InterActiveCorp, or IAC (NASDAQ: IAC). However, the growth of Expedia and other travel assets by IAC meant that travel had grown to over 50% of IAC’s revenue, and was dwarfing the rest of the business, hindering growth and leading to IAC being treated as a travel company by the street. As a result, in December 2004, IAC management announced a plan to separate IAC into two separate companies. One of these companies, which took on the Expedia name, held the assets of Expedia, Expedia Corporate Travel, Hotels.com, Tripadvisor, and several other travel-related companies. In 2005, this plan was executed via a spin-off of Tripadvisor to existing IAC shareholders, taking on the ticker NASDAQ: EXPE [11, 12].

By 2007, Expedia had expanded beyond core travel offerings to also include activities, advertising, and technology solutions such as Media Solutions and Partner Solutions. With over 45mm transactions completed in 2007, the company was growing by double digits across every single metric. In particular, management highlighted international expansion and online proliferation as key future opportunities.

Acquisition Machine

2009 was a difficult year for Expedia given a decline in recreational and business travel, with revenues falling almost 7%. Nevertheless, the company quickly bounced back, supported by the enormous tailwind of online adoption, notching double-digit growth for almost a decade through the end of 2018. This growth was also fueled by Expedia’s return to its early roots: the extensive use of M&A to refine and expand offerings while staving off competitors. Notable transactions are highlighted below:

2011: Spin-off of TripAdvisor into a new public company (NASDAQ: TRIP) to “unlock shareholder value”

2012: Acquisition of a majority stake in TrivaGo for $632mm to increase European presence

2014: Acquisition of Wotif for $658mm to expand into Australia and across APAC

2015: Acquisition of Travelocity for $280mm to consolidate market share

2015: Acquisition of Orbitz for $1.6bn to consolidate market share

2015: Acquisition of Homeaway for $3.9bn to expand into vacation rentals

2017: Acquisition of SilverRail for $148mm for train ticket technology

[14, 15, 16, 17, 18, 19]

By 2019, Expedia had the offerings of a full-service travel agency and then some, with a portfolio of 17 brands. Posting revenue of nearly $12.1bn in 2019 with gross margins of 82.9% and EBITDA margin of 10.9%, Expedia had a highly consistent, cash generative business, something reflected in the company’s approximately $20bn market capitalization [20, 21].

The Disruptors Become Disrupted

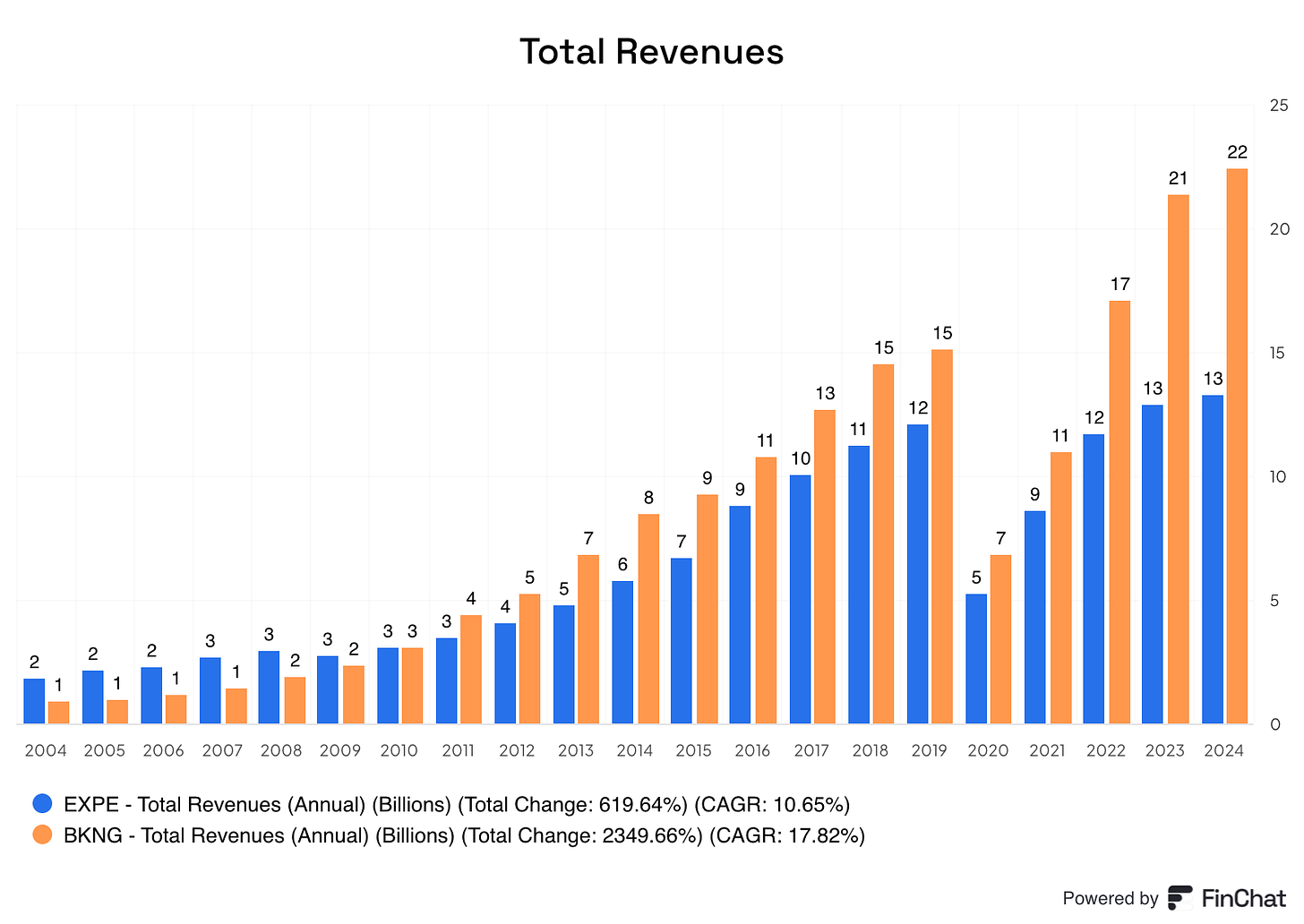

In 2019, Expedia changed its formal name from “Expedia Inc.” to “Expedia Group Inc.,” reportedly in an attempt “to better reflect the global nature” of Expedia’s business, as well as to clearly articulate “who [Expedia] aspires to be.” By this point, Expedia effectively had a duopoly on the online travel services industry alongside Priceline. The month before Expedia’s name change, Priceline had rebranded itself as Booking Holdings (NASDAQ: BKNG). With its name change, Expedia wanted to call attention to the fact that it was a full-service travel agency, offering many more products than Booking. However, Expedia’s rebrand also showed the company’s desire to catch up to Booking Holdings, which had been eclipsing it. While Booking did almost $3.1bn in revenue in 2010, only ~$50mm more than Expedia, in 2019 Booking did over $15.0bn versus Expedia’s $12.1bn [20, 21]

Besides taking more market share than Expedia, the leaner Booking more aggressively pursued a shift from a Merchant model to an Agency model. In a Merchant model, the client pays the full final price to the online travel agency (not to the hotel). Normally after the check-in date, the online travel agency pays the net price (final price minus agreed commission) to the hotel. In contrast, in an Agency model, the client pays the final price to the hotel (either at the time of the booking or at the check in). Typically after the check-out month, the hotel pays the agreed commission to the online travel agency. Hotels loved the many advantages this Agency model offered, which included positive effects on cash flow, reduced risk of the agency going bankrupt without paying hotels, and more information about clients before they arrived at the hotel [22, 23].

However, both Expedia and Booking were facing growing pressure from Airbnb and renewed pushback from hotels, forcing them to increase advertising spending. In the summer of 2019, Expedia CEO Mark Okerstrom unveiled a plan to realign and simplify how the company did business. The company had over 20 brands, with many competing against each other and working at cross purposes. Expedia Chairman Barry Diller, the aforementioned media executive and former head of IAC, decided to go further and consolidate control. First, Diller engineered Expedia’s all-stock acquisition of Liberty Expedia, a holding company that owned both Class A and Class B shares of Expedia. As a result, Expedia’s ownership structure was simplified. Although Expedia was no longer a “controlled company” under Diller, he still controlled about 28% of the company’s voting power. Expedia was also able to retire shares as a result, for a total consideration of $2.85bn [24, 25].

Diller also publicly stated that Expedia’s workplace culture was “all life, no work.” Four months after the unveiling of the new strategy plan, Diller fired the CEO and CFO of Expedia, saying that the board “disagreed on strategy” with them in regards to the “ambitious reorganization.” Upon news of the shakeup, Expedia shares rose 7%. Diller then tapped Peter Kern, Expedia’s Vice-Chairman, for the top job. Kern quickly designated Expedia.com, Hotels.com, and Vrbo as the company’s future core brands, and declared that Expedia would invest in three or fewer brands in any given region [26, 27].

COVID Rescue Financing

In the midst of this tumultuous transition period in December 2019, S&P Global had placed Expedia on its CreditWatch negative list, putting its BBB credit rating at risk. Key reasons cited included “expected change in strategy, recent operating underperformance, and potential for increased share repurchase activity,” with the expectation of adjusted net leverage above 1.5x for a sustained 12-24 month period. While this was supposed to be temporarily painful, things got much worse for Expedia in 2020 as travel declined to levels never seen before. For example, in the second half of March 2020, global travel bookings declined to less than 15% of 2019 levels. As expected, this severely impacted cash flows, forcing the company to look for liquidity solutions [28, 29].

Diller emphasized the dire nature of the situation: “We have one mandate–to conserve cash.” In March 2020, the company drew down nearly all of a $2bn credit facility. The next month, it was announced that Expedia had prevented a crisis by securing approximately $3.2bn of new capital. In addition to $2bn of debt financing in the form of unsecured 6.250% notes due 2025, Expedia raised $1.2bn in a private placement of perpetual preferred stock purchased by Apollo and Silver Lake. As part of the deal, Diller ceded board control to David Sambur, Co-lead Partner of Apollo’s private equity business, and Greg Mondre, Co-CEO of Silver Lake. Expedia’s credit rating was also lowered to BBB- due to higher leverage levels [29, 30, 31].

However, as interest rates declined, Expedia began to reevaluate its capital structure going into Summer 2020. Furthermore, gross bookings, which had declined about 85% in the core lodging business, had “moderated” to around 45% by July. That same month, the company issued $500mm in unsecured 3.6% senior notes due 2023, and $750mm unsecured 4.625% notes due 2027. Expedia then used the proceeds from the offering to redeem outstanding shares of 9.5% Series A Preferred Stock that it issued to Apollo and Silver Lake, which it waited until May 2021 to do following a scheduled decrease in the redemption premium. Apollo and Silver Lake still retained warrants from the deal, which entitled each firm to purchase 4.2 million shares of common stock at $72 per share (compared to share prices in the high sixties at the time of the private placement in April 2020, or ~$85 in July 2020) [32, 33].

In May 2022, as Expedia’s business continued to rebound, the company announced a plan to redeem $1bn of notes maturing 2023 and 2024 with the goal of returning to investment grade status. This was partially enabled by the ongoing success of Expedia’s strategic plan. Specifically, Expedia identified over $900mm of cost saving opportunities (the majority of which were fixed costs), leading to margin improvements. This included the closure of 100 offices and the reduction of total corporate staff by 30% since 2019, including a single mass layoff of 12% of the company’s “bloated” workforce, according to Diller. The company also divested some brands and shut down others, including Classic Vacations, SilverRail, Alice, Expedia Group Multifamily, and BodyBuilding.com [25].

This consolidation showed the way CEO Kern worked to successfully simplify operations and break down the “siloed brands approach.” The company was described previously “as more a collection of distinct trading companies with separate brands, strategies, tech stacks and staffs” rather than being a coherent organization. For example, the Hotels.com marketing team would bid against the Expedia.com marketing team in Google auctions. As part of the reorganization, Expedia eliminated dependency on 76 different [advertising] agencies around the globe and instead built an entire full-service marketing, creative and media-buying team internally. Beyond marketing, the company also rolled out a unified tech stack, which allows it to test and launch new offerings much more efficiently [25].

Conclusion

With demand for its offerings recovered and improving in new ways, Expedia returned to growth, with revenues and margins exceeding pre-COVID levels. Investors rewarded the stock, which reached all-time highs in February 2022. After the post-COVID travel boom naturally subsided, the company has seen some slowdown in global growth, which negatively impacted the stock. However, the company successfully completed its reorganization, and CEO Kern stepped down to pass leadership on to a new CEO, Ariane Gorin. Today, in the words of Kern, the company appears to have been “reset for the future,” and looks to be in a strong place to innovate in the world of travel [34, 35]. Whenever your friends will accuse restructuring of "Simply kicking the can down the road”, bring them up the Expedia story you learned today!

A special thank you to Hebbia for sponsoring this edition and allowing our publication to remain free.

Sources: [1], [2], [3], [4], [5], [6], [7], [8], [9], [10], [11], [12], [13], [14], [15], [16], [17], [18], [19], [20], [21], [22], [23], [24], [25], [26], [27], [28], [29], [30], [31], [32], [33], [34], [35].

Interested in our updated reading / wellness list? Check it out here.

How did you like this week’s Pari Passu? Loved | Great | Good | Meh | Bad

Interested in our IB / PE / HF course recommendation? Check it out here.

Appendix: Some Quick Thoughts from Me on the OpenAI Income Statement