PP: Pluralsight, the Restructuring Deal of 2024 (Special 100th Edition)

Ladies and gentlemen, welcome to the 100th Pari Passu Newsletter.

Before diving in, I just wanted to take a second to thank all of you. Working in Private Equity and keeping the lights on at Pari Passu is not always easy, but I am so grateful for every single one of you reading (to thank you, scroll to the bottom of this email to grab a small gift).

Today, we have a special post to celebrate this amazing milestone: a Deep Dive on Pluralsight, the restructuring deal of 2024. This write-up will be the first in-depth look at the Pluralsight transaction. Below, we will look at the landscape of the private credit market, how the Pluralsight situation came to be, what Vista underwrote in their buyout, what we believe went wrong, and what the implications of the deal are for the private credit market.

At this point, liability management transactions have become a household name for anybody who works in restructuring. While the LMT landscape is constantly evolving, there is one thing that has always been constant about these maneuvers: they all involve public debt. That was at least true until earlier this year, when Pluralsight, a company that was taken private in 2021 by Vista Equity Partners, engaged in a drop-down maneuver that involved stripping assets from private credit lenders. Up until Pluralsight, there had never been a LMT that involved private credit, and the Pluralsight deal will forever shape the landscape of private credit LMTs. Let’s dive in.

Automate finance ops for your portfolio

Ramp works with over 25,000 businesses to help them run their companies more efficiently. We recognize the critical role that finance automation plays in driving value creation for PE firms. With Ramp, you can reduce operating expenses and drive efficiencies across your portcos with real-time spend visibility and Al-powered insights. Time is money. Save both with Ramp.

Automate your finance operations, all in one platform.

→ Corporate Cards

→ Expense Management

→ Travel Management

→ Accounts Payable

→ Procurement

Join the hundreds of private equity and venture capital firms already partnered with Ramp

What is Private Credit?

We have covered this topic in previous articles, but to best understand the Pluralsight situation, we must quickly dive into Private Credit (PC) and how this asset class arose. Private Credit broadly falls under the asset class of leveraged credit (a bucket for corporate bonds and loans that hold a below investment grade credit rating). The corporate bonds consist of High Yield bonds, while the loans consist of broadly syndicated loans and, as of recent, Private Credit.

Focusing on leveraged loans, the broadly syndicated loan market has been a primary growth driver of the leveraged credit market. These loans are provided by banks, with an emphasis on securitization and ensuring returns. It arguably offers the ‘safest’ returns in the leveraged credit market. This is for a few reasons. First, the banks that provide leveraged capital do so with the intention of holding it to maturity and thus have stringent covenants that ensure their returns are maintained even if a company deteriorates during the loan period. Additionally, leveraged loans are usually secured, meaning that they will typically sit above their high-yield bond counterparts [14].

Private Credit / Direct Lending arose as an alternative to leveraged loans. There are 2 stark differences between PC and broadly syndicated loans that explain the rapid growth in popularity [14]. First, Private Credit is not publicly traded, while loans are considered public debt. This means that broadly syndicated loans are subject to more price volatility, which inherently makes them ‘riskier’. Secondly, following the Great Financial Crisis, banks were given very stringent lending requirements, which disincentivized lending towards riskier / over-leveraged companies. These two factors have curbed bank’s appetite to lend in riskier situations, leaving companies in need of capital in a precarious situation. The solution - Private Credit. By not trading on the public markets, private credit lenders became willing to offer capital with ‘looser’ credit terms as access to credit terms was privileged knowledge. Additionally, various private funds had significant dry powder (stored capital that could be used). In the past two years, we have seen a record high in the number of companies that need capital and a record low in the number of banks willing to provide loans. With excess dry powder, private credit filled this gap and has been able to charge higher than normal rates for doing so, making it a very attractive asset class to investors.

Overview of Pluralsight

Pluralsight is a cloud-based platform focused on providing scalable, on-demand technology learning solutions for individuals and businesses, specifically in the IT sector. Pluralsight is meant to revolutionize the traditional in-person, instructor-led training models, which suffer from a lack of scalability and inability to quickly meet consumer’s changing preferences. Pluralsight’s offerings particularly benefit companies, as companies currently suffer from the dilemma of either hiring new talent or training existing employees to meet the skills required in a certain industry. Given the rapid advancements in many industries, companies are now training employees as it is a more cost-effective solution when compared to hiring new employees. So how is this done?

Pluralsight abandons the traditional in-person teaching model by crowdsourcing digital content, vetting that content by professionals, and providing it to customers globally. Specifically, Pluralsight has crowdsourced this content to IT professionals, with over 85% of their revenue coming from Business-to-Business services [3]. As of 2020, Pluralsight had over 18,000 business customers, with a customer base located in over 180 countries [2]. Pluralsight’s products are broadly broken up into 2 categories: Pluralsight Skills and Pluralsight Flows [2],[3]:

Pluralsight Skills: Pluralsight uses machine learning-driven assessments to provide users with Skill IQ, which measures skill proficiency in various technologies (e.g. Java). Additionally, Pluralsight provides a course library hosting thousands of on-demand courses across various technological skill sets such as cloud, IT, etc. Consumers can take personalized learning paths that are tailored to their respective skill levels and goals. Businesses can additionally use this service to track their employees’ skills and usage of the platform.

Pluralsight Flows: Pluralsight’s second product helps aggregate historical data to provide reports to companies on their team’s productivity measures. It studies a team’s software code and works with other tools that a team might use (such as Github). This provides a broad view of what a given team is working on, where they face challenges, and where they are excelling to allow for maximum efficiency and software code quality.

Pluralsight grew in popularity for its user-friendly interface and adaptive features like skill assessments and interactive practice problems that adjust to each user’s skill level and role. This tailored learning experience is unique among platforms. Compared to its competitors, Pluralsight’s offerings are niche enough to attract IT professionals, and consistently updates its database of information to ensure it is up to date. These competitive advantages led to partnerships with firms like Google and Microsoft [3].

Leveraged Buyout and the Downturn

In early 2021, Vista Equity Partners agreed to purchase Pluralsight in a take-private deal for $22.50 per share (approximately a 25-30% premium) and an estimated value of $3.5bn. This transaction included $1.5bn of debt financing (~40% LTV), with over $1bn coming from direct lenders ($1.175bn recurring revenue term loan and a $100mm revolver) for an implied $2bn equity check [1],[4].

As a useful side note, the $1.175bn recurring revenue term loan emphasizes the benefits the private credit can offer. A recurring revenue term loan has covenants that are based on the company's annual recurring revenue. For example, a leverage covenant would be based on its ARR rather than its EBITDA. This effectively ignores the company's operating expenses, providing ‘freedom’ for companies within the credit documents as a company borders a distressed situation [4].

Since the buyout, Pluralsights’ growth slowed as it started to move from a growth to a mature stage company. Over the past three years, the company has undergone a variety of cost-cutting measures to be able to support its annual interest payments. Although the company's revenue has grown, it has not done so at the pace to be able to support this large debt obligation, requiring Vista Equity Partners to request lenders for an amendment of the underlying credit covenants. Specifically, in Q1 2023, the private equity firm requested private credit lenders to loosen their loan covenants (specific terms on the types of covenants have not been disclosed given the private credit documents are kept between lender / issuer) [4],[5].

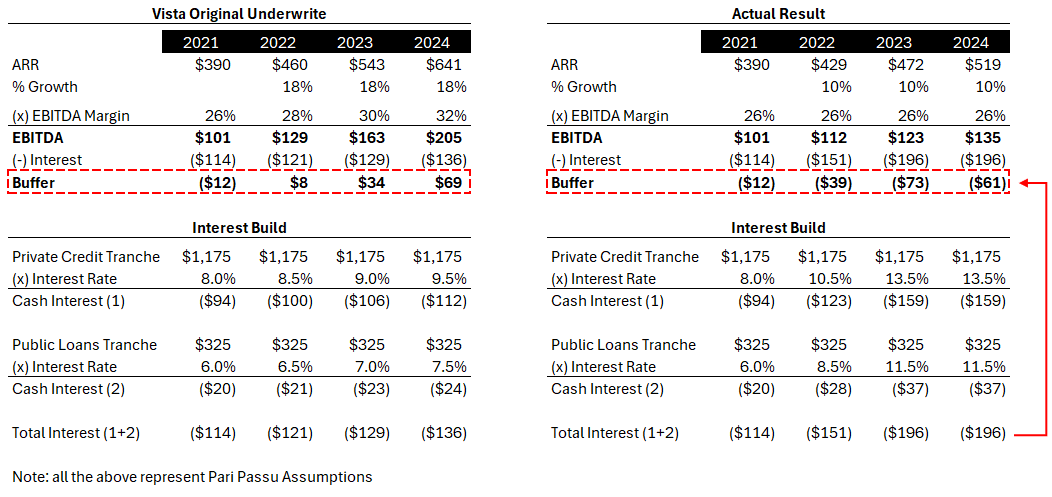

Although Pluralsight is a private company, we can do some rough calculations to understand how the company has ended up in a distressed situation. When Vista bought out Pluralsight, it was reported that the company was generating $390mm in annual recurring revenue. Assuming a 10% CAGR, this leads to $472mm of ARR in 2023. In 2023, it was reported that Pluralsight had a 26% EBITDA margin, meaning it would generate $123mm in annual EBITDA (scroll down to see summary financials). It was estimated that the private credit debt had an interest rate of SOFR + 800. Given that SOFR was approximately 5.5% in June 2024, this means the company had to pay interest expense of $159mm annually ($1,175mm of debt * 13.5%). The remaining $325mm was not issued by private lenders. The specific interest rates on those pieces of debt were not publicly disclosed. However, as stated early on, private credit can charge a greater rate because it is not publicly traded and is thus less risky. Assuming the public loan rates were 200bps cheaper than the private credit rates (SOFR + 600), the interest expense on the old debt is $37mm (325mm of debt * 11.5%). This total interest expense would be $196mm given these assumptions. With an EBITDA of $123mm in 2023, this would lead to a cash burn of $73mm per year. For simplicity, we are ignoring CapEx and Working Capital given these were pretty minimal based on its financials before the take-private.

Let's look at the specific points that drive this cash burn analysis:

Margin Effect: Keeping interest rates and top-line growth constant for Pluralsight, the company would need to increase its EBITDA margins to approximately 43% just to break even. Even for a software company, a margin this high is difficult to obtain. Given that it is unrealistic to obtain EBITDA margins exceeding 43%, Vista Equity Partners likely underwrote some growth in ARR. Pre-take-out, Pluralsight’s topline growth exceeded a CAGR of 20% from 2015-2019. Vista Equity Partners likely underwrote a similar growth rate when completing the deal, but as we will shortly discuss, a small deviation from expectations led to their distressed situation.

Interest Rate Effect: Interest expense is arguably the biggest issue for Pluralsight. In 2021, when the private credit was issued, SOFR was at 0.05%. Thus, direct lenders were able to charge S+800bps (for a total interest rate of ~8% in 2021) and in nominal terms, the total interest seemed reasonable (and very accretive as the equity was likely underwritten at ~20% IRR). Things started to change as rates increased in 2022 and with a ~5% SOFR, the new interest rate of 13.5% started to inflict some serious pain. From a monetary perspective, interest expense only on the private credit tranche (the $1,175mm) increased from $94mm to $159mm (even with the same amount of debt outstanding).

Given this information, let’s try to put ourselves in Vista’s shoes when underwriting this deal. We can distill three key drivers: 1) ARR Growth, 2) EBITDA Margin, and 3) Cost of Debt. We can visualize each of these drivers in Figure 1 below.

On the left side of the image, we can see what underwriters and Vista Equity Partners likely forecasted or anticipated when underwriting the buyout. In the left side assumptions, we can see substantial but reasonable growth for this type of business (CAGR of 18% which was already a haircut on the historical figure), EBITDA margin expansion which we would expect from operating leverage and cost-cutting initiatives (from 26% to 32%), and some sort of rate hikes (50bps rate increase per year) that flow through the cost of debt. Under these assumptions, we can see how the buffer between EBITDA and interest for Vista would be $69mm in 2024.

Now let’s take a look at what we believe happened (right side of the image, please note that these numbers are solely our assumptions). Here, we see that ARR still grows (although more moderately at a CAGR of 10%). Additionally, we are assuming no EBITDA margin expansion (26% from 2021-2024) given the commentary that has circulated about the restructuring. Finally, we illustrate the true outcome of rate hikes, where interest rates increased 5.5% over the 4 years. These small changes led to a year 4 buffer of negative $61mm in 2024. Although none of these changes were dramatic (check out our Envision Deep Dive to see an LBO where things really went south), this is a fascinating ‘case’ as it emphasizes how a moderate change beyond a PE’s underwriting for a given company can completely affect the outcomes of a transaction.

The takeaway from this analysis is how a company that is performing well can still find itself short on cash and in distress if they overlever. Under our assumptions, we still assume Pluralsight’s top line grows at a CAGR of 10%. With strong top-line growth, a constant EBITDA margin alone would not lead to cash depletion (especially given that 26% is in line with market standards). It is thus clear that overlevering a company is a prime consideration for PE firms in these takeouts, as it was the driver of Pluralsights' distress.

As a result of their overleveraged capital structure, Pluralsight had to inject $75mm of equity into the company in Q1 of 2023, but by mid-2024 the company was forced to completely write down their equity investment to $0 [10].

Overview of Drop-Down Transaction

Time to replace my Private Equity Hat with my Restructuring Hat. Let’s do it.

In mid-2024, Pluralsight had an interest payment to make on its debt and was facing a pending restructuring if the company was unable to effectuate a restructuring to reduce its debt and provide additional breathing room. This is where we saw a revolutionary deal. Pluralsight engaged in a dropdown maneuver, where it moved its IP (a substantial portion of the company's total asset value) to an entity sitting inside the company's restricted group, more on this in one second [6].

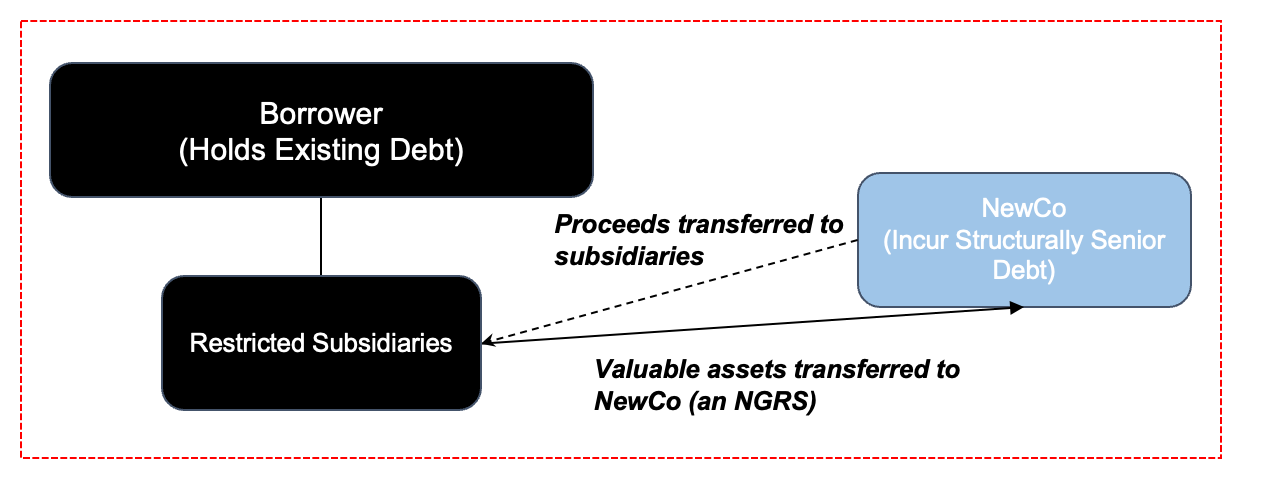

As a reminder, the classic drop-down transaction can be visualized below in Figure 2. In this maneuver, the first step is to create a NewCo that sits outside the restricted group. Companies that sit within the restricted group have to be subject to the tightest covenants at any entity within the restricted group. Next, the company will transfer assets to the NewCo. To do this, the company needs enough “basket capacity”, specifically coming from the Restricted and Permitted Investment Baskets. These baskets state the value of assets that can be transferred to the NewCo entity. Following this, the company can raise structurally senior debt secured by these assets at NewCo. The new debt will be structurally senior because the NewCo entity is not a guarantor (i.e. they do not have to treat the debt within the restricted group as pari with the new debt raised at NewCo). Finally, to ensure that the companies within the restricted group do not file as a result of this maneuver, the proceeds generated from the new debt can be transferred to the entities in the restricted group to fund their operations.

Pluralsight Drop-Down Maneuver

On its own, the dropdown maneuver is nothing new. In fact, it was one of the first liability management exercises done by J. Crew. in 2017. However, the Pluralsight restructuring is revolutionary because it acted against private credit lenders. Specifically, the drop-down entailed moving the IP of Pluralsight to a NewCo entity, with the ability to raise $170mm in total debt. Of this $170mm, $50mm came from Vista Equity Partners in the form of either a preferred equity investment or a loan (reports differ) [5]. The private crest lenders (consisting of Blue Owl and Ares), were left with effectively no collateral. However, a stark difference between this drop-down from previous maneuvers is that the assets were transferred to an entity that was still in the restricted group. However, this entity was not a guarantor, allowing the new debt to still be structurally senior [6],[7],[8].

Figure 3 above shows the stark difference aforementioned. Instead of the NewCo being outside of the credit box, it sits inside. There are a few notes to make on the impacts of structuring a drop-down this way. First, although the subsidiary is in the credit box, it is still not subject to the cover of the debt of the other entities in the credit box. This is because it is a non-guarantor. More simply put, this means that even if the company had to file for bankruptcy, the assets held at NewCo would not have to guarantee any of the debt held at the other entities in the credit box. This ensures that the structural subordination benefits that NewCo has stayed intact.

However, the company post drop-down will not have much flexibility as an unrestricted subsidiary would. This is because if a subsidiary (restricted or not) is in the credit box, it is subject to the tightest covenants in the credit box. This may limit the NewCo in its ability to use the newly transferred assets to do things like raise debt (as the ability to raise new debt may be heavily restricted in the credit docs). For Pluralsight specifically, sources indicate that their ability to raise debt was affected by being a non-guarantor restricted subsidiary; the total amount of debt they were able to raise was $170mm, but if the entity was structured as an unrestricted subsidiary, it likely would have been able to raise for more debt.

So why do companies structure dropdowns via a non-guarantor restricted subsidiary? In reality, no creditor prefers an NGRS over an unrestricted subsidiary. It is done out of necessity. Oftentimes, a company’s credit docs preclude the creation of an unrestricted subsidiary to prevent complete asset leakage from the credit box.

The next question you might ask yourself is: why have liability management transactions not happened in private credit up until now? To answer this question, we have to remind ourselves of why private credit has gained popularity in the last few years. Companies increasingly needed private capital because the public markets were ‘closed off’ to them due to their financial positions. There was excess dry powder in the private markets, and the benefits of not having publicly traded debt made it an attractive asset class. Thus, we can almost view private credit as a ‘last ditch effort’ for non-distressed financing. By engaging in liability management transactions in a private credit deal, which invariably comes at the expense of a private credit lender, you are creating an enemy with the only person willing to provide capital to you. Furthermore, private credit lenders are arguably the last group of investors you would expect to be involved in an LMT. This is because the capital they have provided is given at incredibly flexible terms. While this may come at slightly higher interest expenses, private credit lenders are typically willing to engage in amendments due to the credit’s privatized nature. Thus, a transaction like a drop-down, that will always lead to a creditor group being hurt, is simply not needed in most private credit situations [7].

However, the restructuring did not end there. A few months following the LME, it was announced that the private credit lenders agreed to take 85% ownership of Pluralsight.

Ultimately, this represents the best outcome for both Pluralsight and Creditors at this point in time. Pluralsight has written down its equity investment, and it makes no sense to keep injecting money into the business. Additionally, credit investors likely need a significant turnaround of the business to recoup their investment, and likely need to seek equity-like returns to achieve this. These lenders agreed to inject $275mm of new capital into Pluralsight and pay out the $50mm of capital that Vista Equity Partners injected as a part of the dropdown deal. In taking control of the company, the Private Credit lenders have agreed to convert their debt into new equity, which will reduce the total debt outstanding by approximately $1.2bn. In the end, Vista Equity Partners losses totaled around $2bn. Not great. This came from (i) the initial equity check of ~$2bn (total purchase price of $3.5bn minus $1.5bn funded by debt), and (ii) incremental $75mm of injected equity into the business in Q1’23 as stated earlier [9].

Implications on Private Credit

Given the revolutionary nature of this deal, investors are continually asking themselves: what does this mean for the private credit markets? Broadly, there are two schools of thought. The first holds the view that Pluralsight was a ‘one-off’ event and will be very unlikely to occur again. This was the perspective of the credit rating agency, Fitch. According to Fitch, LMT’s in private credit deals will be unlikely to occur in the future because of the limited number of private credit lenders in the industry. Because there are only a few private credit funds that hold a majority of the dry powder, an increase in LMTs would disincentivize new private credit lenders from entering the market, which would have a net negative effect for all leveraged companies in need of financing. [11],[12].

Despite Fitch’s confidence that LMT’s won't enter the PC market, it appears that private credit lenders are indeed wary of the market, as we have seen an increase in the requests for ‘Pluralsight Blockers’ - a term created to denote the desire of creditors to tighten down on the loopholes in credit docs that allowed for the Pluralsight dropdown to take place. Specifically, some private credit lenders request a blocker to prevent a company from transferring assets to a non-guarantor restricted subsidiary (this blocks a dropdown to an unrestricted subsidiary and a non-guarantor restricted subsidiary like in the case of Pluralsight), and having debt / preferred equity raised specifically from the sponsor to be transferred back to the company [5].

The issue that we see with these blockers is the inherent conflicts between private credit lenders in general. If a private credit lender requests stricter covenants, there will always be another lender who is willing to offer capital for slightly fewer restrictions. For example, one private credit lender might be willing to lend in a deal that has 3 LMT blockers, but given how many lenders are in the market, there is likely another creditor that will offer that same deal, but for 2 blockers. This competition is what has allowed LMTs to continue in companies that have public debt, despite increased blockers being created. Based on this logic, it becomes reasonable to argue that LMTs might continue for companies with private credit for the exact same reason.

This at least appears to be the case already, as reports have come out to indicate potentially another private credit LMT. Khoros, which is also owned by Vista Equity Partners, is a software company that provides social media marketing, analytics, and software management services, has recently become distressed and has begun seeking restructuring alternatives. While this case is developing, its restructuring proposal and outcome will undoubtedly shape the landscape of private credit restructurings for years to come [13].

Thank you again for reading through the 100th Pari Passu Newsletter, this means the world to me! Excited for the next 100 editions! Stay tuned.

📚 Interested in our updated reading / wellness list? Check it out here.

📈 Interested in our IB / PE / HF course recommendation? Check it out here.

👕 Interested in our merch store to shop our latest swag? Check it out here.

100th Pari Passu Edition Thank You Gift

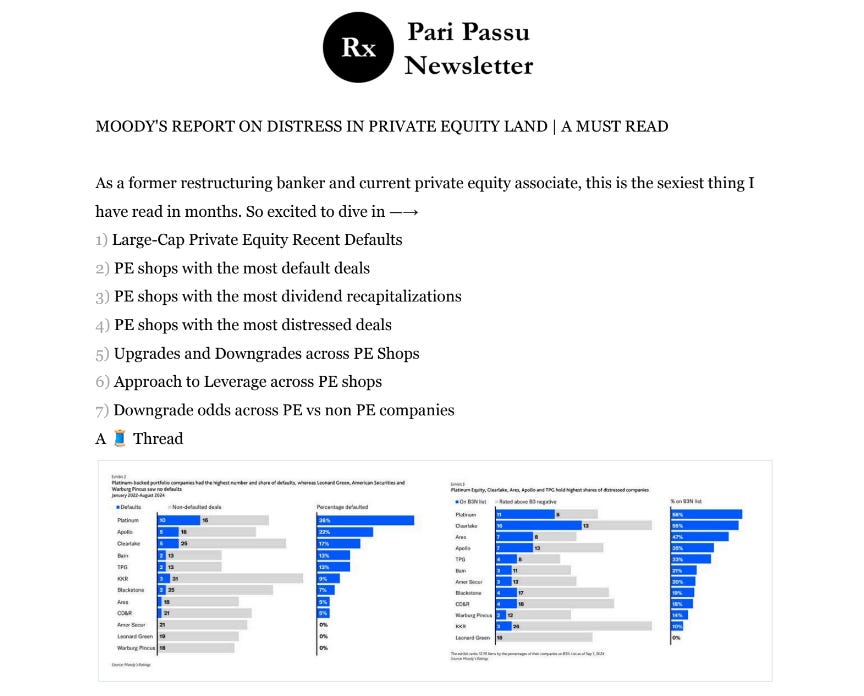

As a small thank you for spending some time with me every Friday afternoon, please enjoy this summary of the recent Moody’s Report on Distressed Private Equity!

If you want more, you can grab here my summary of the JPM Report on Private Credit.