Lumen Technologies: Overview and Liability Management Update

Welcome to the 57th Pari Passu newsletter.

Hope everyone had a great break and is excited for 2024. The team at Pari Passu certainly is so let’s dive right in.

Today, we are going to look at the riveting liability management exchange of Lumen Technologies. This case features several highlights including contention over past sales and exchanges, deceptive credit documents, and more.

Chapter 1: Lumen and Industry Background

Lumen Technologies is a telecommunications company that provides services and communications infrastructure to residential, wholesale, enterprise, and government customers. The company was founded in 1930 and initially called CenturyLink and was renamed Lumen in 2020. The firm has two revenue segments: its Business (accounting for 79% of total revenue and dedicated to enterprise and commercial customers) and Mass Markets (accounting for 21% of total revenue and dedicated to consumer and small business customers). Lumen provides various services across these segments, including computing and application solutions, fiber infrastructure, IP and data, and voice-related services. Lumen is primarily known for its global fiber optic network, covering North America, Europe, and Asia.

Lumen operates under three brands: 'Lumen,' 'Quantum Fiber,' and 'CenturyLink.' The Lumen brand is their flagship for serving the enterprise and wholesale markets. The Quantum Fiber brand focuses on fiber-based services provided to residential and small business customers, and the CenturyLink brand is the long-standing brand providing mass-marketed legacy copper-based services.

There are a few key trends to note in the Telecom space that Lumen operates in. Over the past 3-4 decades, the space has been dominated by players such as AT&T, Dish, Frontier, etc. Previously, the entire telecommunications system was broken down into traditional copper lines. Over the past three years, however, this entire infrastructure has been uprooted, with fiber installed globally. Fiber assets are the crown jewels of telecommunication companies. The reason for this switch is multifold.

First, fiber optic cables have significantly higher bandwidth than copper cables, which can carry more data. This increased data also increases data transfer rates, as fiber can support internet speeds into the gigabits per second range. In contrast, copper is limited to megabits per second.

Secondly, fiber cables can transmit data over much longer distances and experience less signal loss over these distances when compared to copper.

Finally, fiber provides increased security as it is more difficult to tap into a fiber optic cable to intercept the transmitted data, and these cables are also less prone to damage from environmental factors.

These factors make fiber desirable to telecommunication companies as it will likely be a cost-saving switch in the long term and allow them to keep up with the rapidly changing data consumption trends. It is important to note, however, that fiber cables are initially significantly more expensive than copper cables, costing companies billions of dollars of capital expenditures to develop and install this new infrastructure.

Lumen has been experiencing declining profits since 2018, with revenues dropping from $22bn to $17bn in 2018 and 2022, respectively. In 2023, sales are expected to decline even further with the sale of the company's EMEA business. Furthermore, the company is expected to report negative free cash flows at year-end, ranging from ($500mm) to ($1bn), without taking into account the EMEA assets sale. Below is an image from Lumen's Investor Day presentation in June of this year, illustrating the company's internal outlook.

(Investor Presentations), [7]

Chapter 2: Key Acquisitions and Divestitures

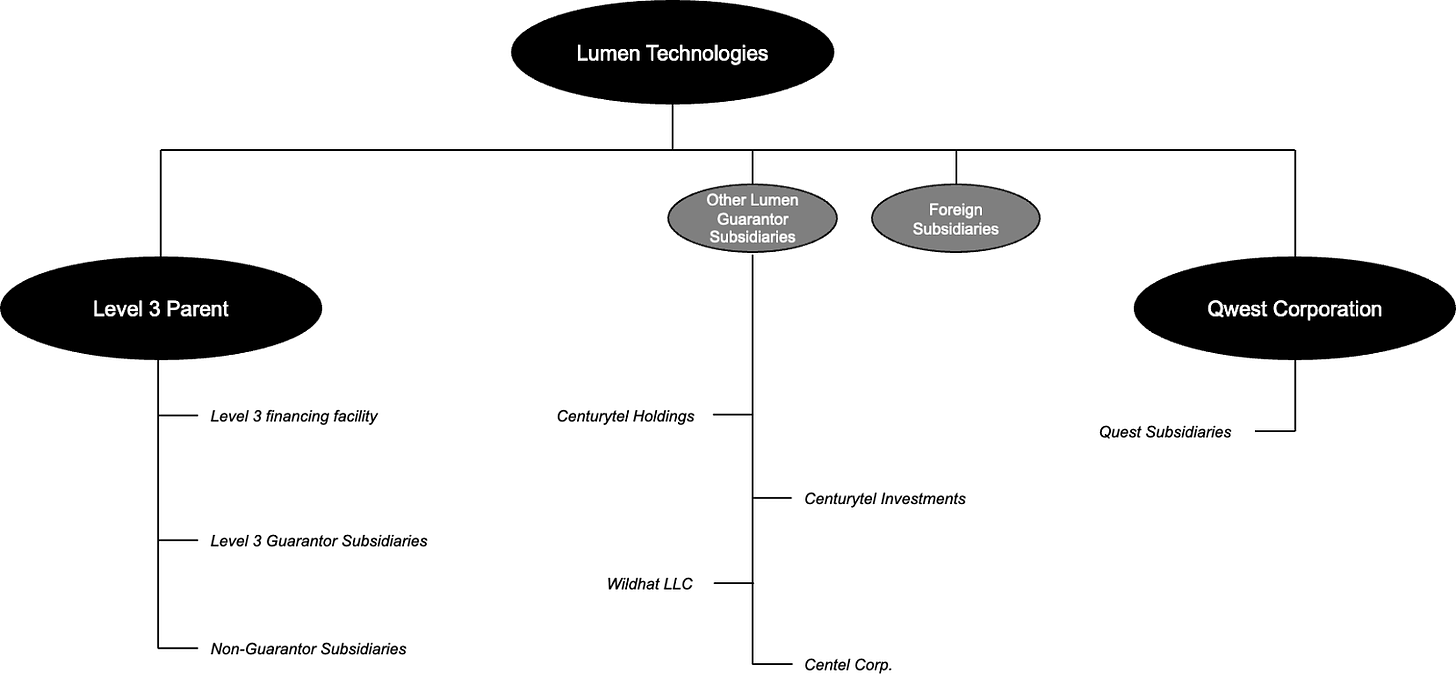

Before going into Lumen’s acquisitions and divestitures, let’s look at the company's organizational structure. Lumen technologies can generally be broken down into three different silos: Lumen Technologies (the parent company), Qwest Corporation, and Level 3.

Debt is currently incurred in each of these silos. While we will later explain the importance of the covenants surrounding the debt in these silos, it is essential to note some critical features for now. As you can see below, Lumen Technologies is the parent company that owns Level 3 and Qwest, and as such, the Lumen debt applies to the Level 3 and Qwest debt as they are non-guarantor-restricted subsidiaries under the Lumen credit documents. However, the debt in Level 3 and Qwest does not apply upwards. In simpler terms, this means that, for example, the leverage ratio covenants at Level 3 and Qwest include the debt held at the parent company. In contrast, the leverage ratio covenants at the parent company do not include Level 3 and Qwest’s debt. Additionally, debt at Level 3 or Qwest could cause cross-defaults to the parent company, but defaults at the parent level would not cause defaults at Level 3 or Qwest.

[2]

Growth through acquisitions

Since Lumen's incorporation, the company has grown primarily via acquisitions. A few key acquisitions include the 2009 acquisition of Embarq Corporation, the 2011 acquisition of Qwest Communications International, and the 2017 Lumen acquisition of Level 3 Communications.

The Level 3 acquisition was particularly notable for a few reasons. First, Level 3 provided Lumen exposure to the fiber infrastructure space. This is a distinct strategy of Lumen versus their competitors. While other telecommunication companies engaged in internally developing fiber infrastructure, Lumen bought their way into the space. This has resulted in significantly fewer capital expenditures over the past few years (in contrast to their competitors who have increased capital expenditures over the past five years).

Additionally, the theory behind the acquisition was as follows: Level 3 provided a separate entity from Lumen that could represent the good parts of the business, as the Lumen entity itself consisted of the legacy copper infrastructure products. Because Level 3 was a subsidiary of the parent company, Lumen tried to generate as much cash as possible from their legacy assets (TV and cable, for example), even if that meant taking substantial discounts on their sales. Any cash generated could then be funneled into the Level 3 subsidiary, which contains the company's going concern value.