TriMark USA, Sacred Rights, and Expectations Investing

Investing, Banking, Restructuring, Podcast Summaries, and Niche Finance Topics

Welcome to the first Restructuring newsletter,

Thank you for subscribing.

Today, we will learn more about:

TriMark USA

Sacred Rights

Expectations Investing

TriMark USA

In 2017, Centerbridge Partners and Blackstone Tactical Opportunities Fund acquired TriMark USA, the largest restaurant supply and equipment company, in an LBO with $800M of term loans. TriMark was acquired from Warburg Pincus, which had grown the firm from $1B to over $1.8B, and had acquired Hockenbergs, RW Smith & Company, and Adams Burch. Jefferies, Barclays, Nomura and Citizens bank provided committed financing, and the loans offered lenders first and second recovery priority in the event of a default, split between a senior tranche worth $560M, and a junior tranche at $235M. The transaction was valued at $1.265B, implying a 10x EBITDA multiple. TriMark was an attractive acquisition due to its historically stable revenue growth, long-standing relationships with over 80,000 customers, and defensible market position. However, due to COVID-19 the foodservice equipment industry was negatively affected due to the industry's sensitivity to consumer demand and lockdown restraints. This led to TriMark USA facing a liquidity crisis and requiring additional financing to continue operations.

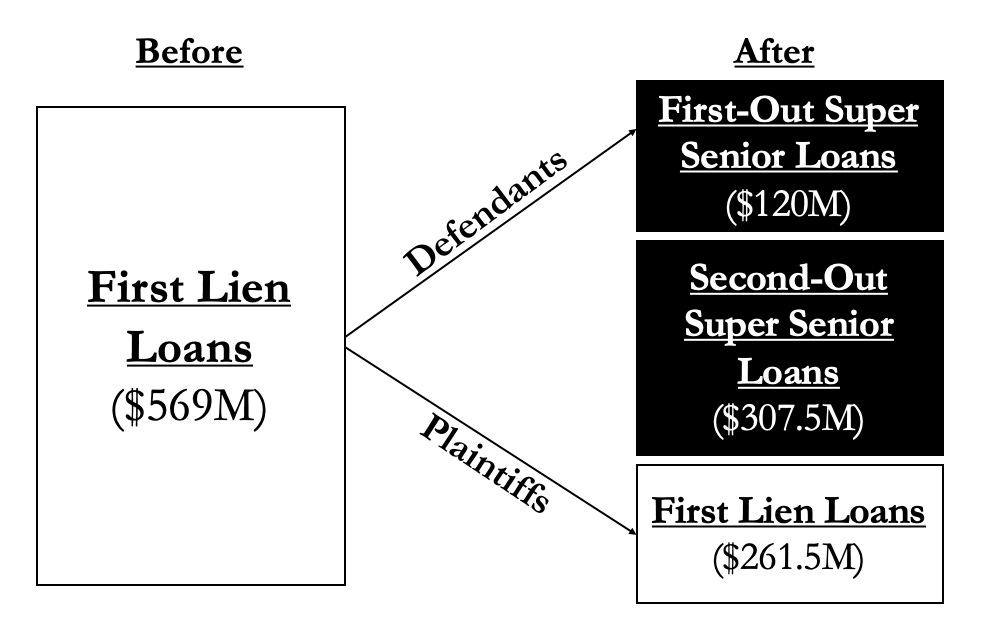

Thus, a committee was formed to work on determining any additional liquidity, and to explore potential pro-rata financing options. A new deal was reached which created a new class of lenders by amending the initial agreement. This deal included creditors, Ares and Oaktree Capital offering a $437.5M rescue package to Trimark in September 2020. This rescue package was split between a “New Money Tranche” of $120M super-priority “first out” debt which ranked ahead of existing First Lien Term Loans, and a “second-out” tranche of $307.5M of super-priority debt ranked ahead of existing term loans. The New Money Tranche provided $120M of additional liquidity to support the companies working capital to meet improving demand as the industry recovered from the pandemic, and the Second Out Tranche was used to purchase $307.5M of the original First Lien Term Loans at par. Before diving deeper into the transaction, it is important to understand some of the intricacies of the case.

A no-action clause is a provision in an indenture that specifies when and how bondholders can take legal action against the issuer of the debt. These clauses are included to protect the issuer by requiring bondholders to seek approval from the other bondholders before taking legal action. No-action clauses also typically require bondholders to go through an intermediary, such as an indenture trustee, before taking legal action. This helps ensure that the interests of all bondholders are considered before any legal action is pursued. There are some instances where bondholders can pursue legal action against the issuer of a debt instrument, even if it is not specified in the no-action clause of the indenture (the legal document outlining the terms of the debt). Basically, only the trustee can take action against the issuer of the bonds.

Only when the trustee fails to take action in accordance with the bond documentation, can bondholders take legal action. These exceptions may vary among indentures, but most indentures have a set of common requirements that must be met before bondholders can take action. These requirements may include nonpayment of principal or interest, a minimum number of bondholders (usually 25% or more) seeking a remedy, and the failure of the indenture trustee (a third party responsible for enforcing the terms of the indenture) to take legal action. Bondholders may also be able to take legal action if the indenture trustee has a conflict of interest. In most other cases, bondholders are required to take collective action through the indenture trustee.

The term "sacred rights" refers to specific rights or privileges that are regarded as untouchable or inviolable. The provisions of a restructuring plan or agreement will usually protect these rights, which are normally awarded to a specific group or class of stakeholders. Examples of sacred rights provisions might include the right to receive a certain level of compensation or benefits, the right to participate in certain decisions related to the restructuring, or the right to retain certain assets or property. These provisions may be included in a restructuring agreement or plan in order to provide some level of assurance to the stakeholders that their rights will be protected. Sacred rights provisions are often seen as an important tool for promoting fairness and equity in the restructuring process, and they can help to ensure that the restructuring is successful and sustainable in the long term.

Lenders, such as Z Capital Credit Partners, Golub Capital, Shenkman Capital Management, BlueMountain, and others, sued Trimark USA to void the financing that they received in September, fearing they may be wiped out in a bankruptcy. Defendants included, Blackstone, Centerbridge, Ares, and Oaktree, amongst many others.

What was this agreement? There were three main components: [1] TriMarkentered into a “Super Senior Credit Agreement” where “First-Out Super Senior Debt” was issued to the participating lenders (this was not offered to non-committee LBO loan lenders). [2] “Second-Out Super Senior Debt” was issued in a dollar-for-dollar exchange for the initial debt the participating lenders held in the LBO loan. [3] Covenants were stripped from the original agreement allowing TriMark to incur new debt senior in priority to the original agreement, subordinate the LBO loan’s collateral position, and establish a “no-action clause” that precluded lenders from pursuing action against Trimark or other lenders.

The alleged covenant-stripping included removing the Plaintiff’s rights to information and removed bargained-for protections. Essentially, this restricted the plaintiff’s abilities to make informed decisions on their debt, as they were not sure on whether to keep or sell their debt.