PP: SoFi Deep Dive, Revolutionizing Loan Underwriting

Welcome to the 98th Pari Passu Newsletter, two weeks away from an amazing milestone!

In the last non-restructuring edition of October, we’ll delve into the story of SoFi, the firm that disrupted legacy financial service providers with its unique approach to data analytics.

Under the leadership of CEOs Mike Cagney and then Anthony Noto, SoFi has provided an all-in-one solution for clients, at costs that are significantly below competitors. Additionally, SoFi’s strategic acquisitions, product expansion, and use of artificial intelligence (AI) in customer acquisition have increased its market penetration and raised the firm to a household name.

While SoFi is one of the largest firms in financial technology, the company’s history is rocked with scandals and at times questionable decision-making. Let’s explore how SoFi overcame these initial challenges to acquire the brand name it has today!

But first, a message from 10 East

10 East, led by Michael Leffell, allows qualified individuals to invest alongside private market veterans in vetted deals across private credit, real estate, niche venture/private equity, and other one-off investments that aren’t typically available through traditional channels.

Benefits of 10 East membership include:

Flexibility – members have full discretion over whether to invest on an offering-by-offering basis.

Alignment – principals commit material personal capital to every offering.

Institutional resources – a dedicated investment team that sources, monitors, and diligences each offering.

10 East is where founders, executives, and portfolio managers from industry-leading firms diversify their personal portfolios.

There are no upfront costs or minimum commitments associated with joining 10 East..

Section 1: History

Early Financial Services

In order to understand SoFi, we need a bit of background on the predecessor technology. Banking technology was historically built on outdated programming languages such as COBOL and Fortran. This aging technology has proven to be costly and has hindered banks' ability to innovate and adapt to changing customer needs. For reference, a report shared that 75% of banks struggle to integrate new technologies with their legacy systems [1][2]. While understanding the technicalities behind COBOL and Fortran is not essential, here is a very short summary.

Common Business Oriented Language (COBOL) is a programming language developed for business applications for processing large data sets. COBOL's limited data types and lack of modern programming constructs make it difficult to integrate with newer systems. Its verbose code and outdated programming paradigms lead to increased development time, higher maintenance costs, and limited scalability.

FORmula TRANslating system (Fortran) is a programming language developed in 1957 for scientific/engineering applications for numerical computations. Fortran's outdated limited support for modern data structures makes it inefficient for modern software development. Its lack of modular programming and limited support for parallel processing hinders its ability to handle large-scale computations and big data.

The implication of this lack of innovation not only impacted the internal operations of financial services but also inhibited their ability to generate revenue. Particularly, the loaning operations that drive the revenue in traditional banks had low predictability. As the traditional credit scores of banks didn’t take modern data analytics into consideration, there was a clear opportunity for a new entrant.

Enter SoFi Technologies

SoFi, originally known as “Social Finance” was founded in 2011 by four Stanford graduates: Mike Cagney, Dan Macklin, James Finnigan, and Ian Brady. Noticing the illiquidity of the student loan market and the lack of data analytics used by legacy banks, these four students launched SoFi as a student loan refinancing platform [3].

In the middle of 2011, these founders started their inaugural loan program where they sought $2mm from forty Stanford alumni and then dispersed it to eighty-five students on campus. Due to the confidence of the alumni in the student borrowers, the founders were able to offer a lower interest rate on the debt than what was available in traditional student borrowing programs [4][9].

While this will be explained in more detail in the overview section, these founders were able to overcome many of the traditional issues with legacy lending practices.

Cash Flow Assessment: Traditional systems based credit scores on a client’s current cash flow, rather than their future cash flow. This was ineffective because students who would graduate and pursue high-paying careers would be denied a loan due to their current minimal cash flow. SoFi took future cash flow into consideration, which allowed them to provide financing to the student loan market and charge lower interest rates.

Online Crowdsourcing: The traditional fees of banks are passed on to customers, but SoFi removed these as they were an online platform. This allowed them to charge a 6% interest rate, which was 0.4% lower than private loans offered by banks [9].

With this loan program, the founders realized that by using information outside of credit scores they could provide attractive financing rates for students. By 2012 SoFi expanded to 40 universities and offered $150mm in student financing. It was from this point that SoFi began its period of rapid growth.

SoFi Begins Its Expansion

While SoFi started off strong, there were many critics of the firm’s business model. However, as the firm scaled, SoFi was able to come up with various solutions [14].

Critics questioned the risk of bypassing conventional banks. SoFi’s approach deviated from the traditional lending model, where banks act as intermediaries, and critics worried about the potential consequences of disintermediation. To address concerns around credit risk, SoFi leveraged data analytics to assess creditworthiness.

In addition, critics questioned the reliability of these metrics, worrying that they might not accurately capture credit risk and they raised concerns about biases in the algorithms used to evaluate borrowers.

Finally, many were unsure about SoFi’s ability to navigate the regulatory environment around financing.

There were two ways that SoFi could expand: vertically and horizontally. Vertical expansion consisted of enhancing the firm’s lending capabilities, and horizontal expansion meant expanding into new financial services. Mike Cagney, SoFi’s first CEO, decided to pursue the horizontal expansion strategy by growing the firm’s offerings [4][6].

In 2012, SoFi introduced its student loan system to refinance federal and private student loans. SoFi attracted users with lower interest rates, smaller monthly payments, and only single repayment terms. Their “edge” was that data analytics allowed them to charge these low rates while keeping default rates low.

By 2014, SoFi expanded its product line by introducing personal loans and an MBA loan program

With the growing real estate market in 2015, SoFi decided to enter the home loan market. The same year, they introduced the Parent PLUS Loan Refinancing product, which allowed parents who had taken out loans for their children’s education to refinance at lower rates.

Then, in 2016, SoFi launched SoFi at Work, an initiative designed to provide student loan repayment benefits to employees. They also introduced SoFi Protect including life insurance and eventually expanded to other types of insurance products.

The horizontal expansion was getting realized and Cagney made the decision to expand into other financial services outside of lending. Between 2016 and 2017, Cagney helped launch SoFi Money, SoFi Relay and SoFi Invest [3]. These financial service products will be explained in more detail in the “Overview” section.

The CEO Transition

While SoFi was externally a powerhouse in financial services with a $4bn valuation, internally the company had many issues. Reports described the company culture under Cagney’s leadership as a “frat house” with a free-for-all ethos that fostered a toxic work environment. Cagney in particular faced many sexual assault and misconduct allegations, which eventually led to his resignation in September 2017 [6][7].

SoFi was caught in a troubling position as they urgently needed to restructure the organization, while also pursuing growth. After sorting through various CEO candidates, SoFi’s board found a strong choice: Anthony Noto.

Noto was the best candidate for SoFi, as his background and past experiences provided the best leadership values for SoFi to restructure its operations [9].

Noto received an MBA at Wharton and then left to work at Goldman in 1999, where he became a managing director in 2004. Noto’s period at Goldman would bolster his passion for acquisitions, an important tenet of SoFi’s future growth prospects.

Then, Noto became the COO and CEO of Twitter from 2010 to 2017, where he helped the firm monetize its user interface. This monetization process interested SoFi, as they were looking to expand their financial services, and return more capital while outperforming their peers.

Noto then resigned from his position at Twitter to join SoFi in 2018 when SoFi was filled with media controversy from Cagney’s management and had an Apple Store rating of 2.9 stars. Despite the poor position of the firm, Noto set out on achieving his goal of making SoFi the one-stop-shop for all financial services.

One of Noto’s significant contributions to SoFi is his expansion of the firm’s vertical expansion strategy, which first started by targeting medical students [3][4].

As we all know, the process of becoming a doctor is very long with students spending four years as an undergraduate, four years in medical school, four years in residency, and then three years in a fellowship. In total, the process takes around eleven years and therefore requires lots of financing.

Many medical students prefer to take out loans for medical school, and the interest for these loans is negotiated to be paid-in-kind (PIK) which allows the borrower to take out loans to not pay cash interest payments on a recurring basis, and instead pay a higher principal payment at maturity.

Due to the loans being PIK a student might take out a $150,000 loan, and then it accrues to $250,000 by the time they become a doctor (yes, a lot of interest).

SoFi started to issue low-rate loans to medical students in residency, acquiring market share from their legacy competitors [3][4].

SoFi found that medical students in residency earning $60,000 annually were forced to accept high loan rates. Their credit score was judged on their current cash flow, rather than their future $500,000 salary. Additionally, 97% of students in residency become doctors which means that lending to these borrowers would have a very low default rate.

While banks treat these borrowers as debtors with no job experience, limited credit profile, and inadequate salary, SoFi used a different forward-looking approach that allowed for differentiated underwriting.

SoFi also gave borrowers the opportunity to pay off amounts of their loan during the lending period at $2,000 a month. This prepayment option severely de-risked SoFi’s lending practice, as they were able to get more cash upfront.

The alternatives simply couldn’t compete with SoFi’s offering [9].

Medical students could keep taking federal loans at ~7% interest rates or they could pursue private loans at ~9% when SoFi was charging sub-6%

There was the option for loan forgiveness which meant that students had to work for non-profits or in government institutions for ten years. These options would require lots of time, and sacrifice, and hurt the medical student’s recruiting options into hospitals

Finally, there were income-based repayment options. However, these require users to reapply every year and they were only for students that displayed financial hardship.

Noto also executed other initiatives to expand SoFi’s operations to become his ideal “super app” for financial services. The three main steps that Noto aimed to pursue included executing the financial services and lending segments, starting a new segment in enterprise AI, and then building brand awareness. These topics will be explained more in-depth in the overview section

Financial Services Execution: SoFi introduced the SoFi Credit Card which had rewards to pay down loans. Additionally, the firm introduced SoFi Home Loans, SoFi Protect, which provided insurance solutions, and then Lantern which was a marketplace for third-party lending [5].

Enterprise AI with Galileo: In 2020 Noto led SoFi’s acquisition of Galileo Financial Technology for $1.2bn in cash. Galileo is a software platform that leverages AI to help fintech firms to manage their services such as digital banking, payments, or managing card issuing [9].

Building Brand Awareness: In September 2019, Noto secured a twenty-year agreement with the National Football League (NFL) for a “SoFi Stadium” in Inglewood, California. The contract required that SoFi pay $30mm per year, however, Noto found the deal attractive, as it would expand its brand awareness. Additionally, Noto would pursue a marketing campaign to expand SoFi’s presence, which will be explained in further detail in the next section [9].

IPO through SPAC

After SoFi’s many rounds of private financing in the 2010s, the firm eventually decided to conduct an initial public offering (IPO) through a special purpose acquisition company (SPAC).

On May 28th, 2021 SoFi merged with the SPAC Social Capital Hedosophia Holdings Corp. V (NYSE:IPOE). Yep, if you had heard of this name you are right. This is the SPAC led by the real Chamatha Palihapitiya…

The SPAC approach provided various two benefits to SoFi, which is why many believe Noto ultimately chose to pursue this approach [15][16][17][18].

Conversion Benefits: Before its IPO, SoFi had $1bn in preferred equity, which functions similarly to debt but does not require principal repayment at maturity, instead providing consistent dividend payments. US regulations mandated that SoFi obtain a banking license to sell this amount of preferred equity prior to its IPO. However, SoFi's status as a "bank" was contested due to its technology-driven approach, which regulators did not view as fitting the traditional banking model. Therefore, Noto opted for a SPAC as a strategic maneuver to navigate regulatory challenges and convert the firm's preferred equity.

Ability to leverage retail enthusiasm: the ability to include future projections and tell a story that resonated with many of its customers (as SoFi primarily targets consumers vs other B2B businesses), enables the company to take advantage of very positive financial markets and minimize dilution. On the other end, performance has not been great since then.

Section 2: Overview

Company Overview

As we know by now, SoFi is a fintech company that has three main segments: lending, financial services, and then enterprise AI [7]. Let’s dive into some details.

The lending segment consists of student loans, auto loans, and home loans, with each type of lending consisting of 60%, 35%, and 5% of the total lending segment. Typically personal loans have higher interest rates around 13%, and mature in two to seven years, while student loans have the lowest interest rate, around 6%, and have a longer maturity. SoFi’s business model involves lending to external parties with unique credit offerings that undercut competitors and then recycling the capital for further lending.

The financial services segment consists of services such as SoFi Invest, Money, Insurance, Credit, Lantern, Relay, Protect, At Work, and ECM. Each of these services will be explained below.

Finally, SoFi’s enterprise AI segment consists of the services provided by Galileo and Technisys, and the subscription revenue that they gain by charging fintech clients to use their services [3].

SoFi’s customer targets are Gen Z and millennial customers as they have the current highest financing needs out of any demographic. Additionally, SoFi aims to cross-sell its services to these customers, increasing its average revenue per user (ARPU). The firm’s ultimate goal is to create a “super app” which will be a one-stop shop for all financial services [3].

Product Portfolio

SoFi’s three segments also have their own product portfolios, and they are outlined below.

First, SoFi’s lending segment contributes to 30% of the firm’s revenue and is one of its oldest segments as we learned in the first section. In total the firm has $20bn lent out through personal loans, student loans, home loans, and auto loans. Relatively straightforward lending arm [7][12].

Next, SoFi provides various financial services to its customers, with the main products being SoFi Invest (a brokerage platform) and SoFi Money (a cash management platform). Many of these services are used in tandem with one another, leveraging the fact that client on SoFi Invest has a 50% probability of opening an additional account in another one of SoFi’s financial products [11][12].

Finally, SoFi offers a variety of enterprise AI products through its Galileo and Technisys platforms. Most of the revenue from this segment is received on a recurring basis, as clients acquire subscription packages. These segments are a bit less intuitive:

Galileo is cloud-based payment platform for real-time payment processing, fraud detection, and account management. Galileo enhances SoFi's payment capabilities and reduces fraud risk, allowing SoFi to offer more efficient payment services to its clients.

Technisys is digital banking platform offering features such as core banking processing, account opening and management, and payment processing. Technisys enables SoFi to offer a digital banking platform to clients, allowing for account management, payment services, and lending options, all in one place.

If easier to understand, this reminds me of what Amazon did with AWS. Enable other companies to leverage the infrastructure created over years of operations, and get paid for it (of course).

Unit Economics and Financial Performance

While SoFi records revenue through a variety of avenues, the main steps required for revenue generation are the following:

Customer Acquisition: SoFi leverages a variety of sales and marketing services to acquire customers

Product Offering & Approval: SoFi offers a range of products of customers to choose based on their preferences. These customers apply for their desired financial products on SoFi’s platform. This process involves completing an application with necessary documentation, undergoing a credit evaluation, and finishing other assessments.

Funding: Once approved, SoFi distributes funds for loans, or initiates investments and other financial transactions as per the customer’s request.

Revenue Generation: SoFi realizes revenue through a variety of avenues. For financial services, SoFi charges a transaction fee as a percent of purchase, as customers invest in various financial instruments on the site. For loan services, customers pay a recurring interest expense to SoFi, and for AI solutions like Galileo, SoFi charges a subscription fee and collects recurring payments from clients who use the software.

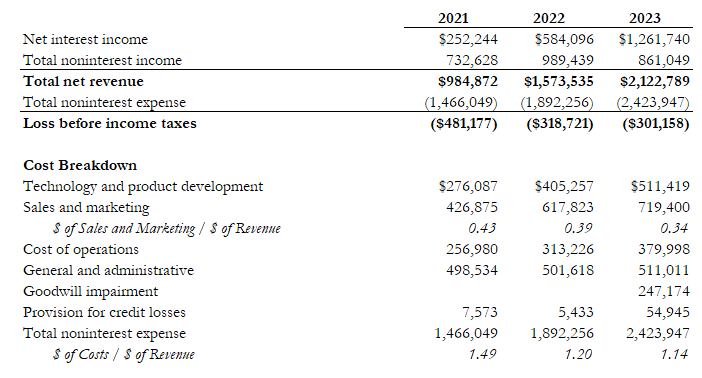

In terms of fundamentals, the poor stock performance hides the business trending in the right direction. Revenue has over doubled since the year of the SPAC, and while the company is yet to be profitable, the unit economics are getting better as the second table shows.

Additionally, another datapoint that the company reports is Total Members defined as “someone who has a lending relationship with us through origination and/or ongoing servicing, opened a financial services account, linked an external account to our platform or signed up for our credit score monitoring service.“ which shows the strong business trajectory the company is on.

Industry Overview

The financial services market is valued at $31 trillion, and is expected to grow at a 7.7% CAGR [19]. However, within that market, the fintech sector is valued at $248bn, 1% of the global financial market, and is expected to grow at a 12.3% CAGR [20]. This higher growth rate is due to the capital-light nature of fintech businesses, which allows them to rapidly scale and penetrate their parent sector. Additionally, SoFi’s enterprise AI segment, with Galileo, occupies the AI fintech market which is valued at $10bn and has a 20% CAGR [21].

After segmenting each of SoFi’s sectors of competition it is apparent that the firm occupies the highest growth verticals within its sectors. SoFi’s advantages within these verticals such as fintech and AI, have allowed it to quickly disrupt the financial services market.

Specifically, the fintech market that SoFi inhabits has many recent trends that have helped and hurt the firm’s recent growth.

Digital banking is expanding, with fintech banks projected to reach 53mm users in the U.S. by 2025, up from 14mm in 2020. Increased consumer adoption of mobile banking apps has been accelerated by the pandemic, leading traditional banks to enhance their digital offerings to compete with fintech firms like SoFi [22].

Advances in AI are driving personalized financial services. McKinsey reports that personalization can increase revenue by 10-30% and enhance customer satisfaction and SoFi is ready to ride this wave [23].

Evolving regulations aim to enhance transparency and security. In the U.S., regulatory frameworks are adapting to fintech innovations, with the Office of the Controller of the Currency issuing bank charters for fintech firms to streamline compliance. Recently, SoFi adopted a bank charter through this program and will be an important next step for the company. SoFi’s charter will be explained in more detail below [25].

While competitors such as Robinhood, Cashapp, Paypal, Money Lion, and Chime began adapting to these trends in fintech, SoFi remains a dominant player. SoFi’s enterprise AI segment with Galileo and Technisys have allowed the firm to be a key bottleneck in the fintech supply chain.

Galileo & Technisys

SoFi uses Galileo and Technisys to streamline its operations and enhance its product offerings, while also gaining visibility into its competition.

Galileo, a platform that SoFi acquired in 2020, provides the infrastructure for banking operations through data analytics. This includes functionalities such as account creation, card issuance, transaction processing, and ID verification [8][26].

With Galileo, SoFi can facilitate electronic fund transfers, including paper and wire transfers, crucial for efficient money movement.

These capabilities are extended to support emerging payment trends such as "Buy Now, Pay Later" (BNPL), which offers consumers an alternative to traditional credit by allowing them to purchase goods immediately and pay in installments over time.

Galileo does not just power SoFi; it is the backbone for SoFi’s competitors such as Robinhood, MoneyLion, Dave, and Chime [5].

As a Backend-as-a-Service (BaaS) provider (yes, yet another declination of [x]aaS), Galileo also reduces the barriers to entry for fintech firms by handling regulatory requirements. Galileo Instant, for example, reduces the setup time for fintech options, from 18 months to just a few weeks [15].

On the other hand, Technisys offers core banking solutions that ensure SoFi operates in compliance with banking regulations. By handling the workings of core banking functions, Technisys allows SoFi and other fintech firms to focus on client-facing products without compromising on regulatory demands [26]. Galileo has rapidly grown with a revenue CAGR of 35% since SoFi’s IPO [9].

User Tracking for Lending & Financial Services

SoFi employs a comprehensive approach to track and acquire customers, leveraging a data analytics infrastructure to expand its customer base. (This section ended up being very detailed, if you are short on time, skip to “Section 3: Looking Ahead”)

This customer acquisition approach can be split into three main categories [11].

Partner Payment Tracking: involves SoFi working with affiliate companies who advertise SoFi’s products. In return, these affiliates receive compensation for their contribution to the customer acquisition process. However, as will be shown below, the process of calculating this compensation can be data-intensive.

Marketing Stack: SoFi provides its own advertising services through various avenues such as digital ads and emails. These different advertising funnels come together to create the “marketing stack”, which is SoFi’s proprietary data platform, which can then be utilized to change how they structure their products or appeal to customers.

Data Instrumentation: This is the final step of the user tracking process as it involves utilizing the data received from the marketing stack and the partner payment tracking platform to then implement advertising initiatives. This step utilizes search engine optimization which involves searching through SoFi’s data sets to find specific pieces of data, and then come to strategic conclusions.

Each of these categories responds to different steps of SoFi’s custom acquisition process. The steps of this process for the lending segment are outlined below. Collectively, these steps are referred to as SoFi’s marketing funnel, as customers who begin in the initial steps of the process may “drop-off” from the sign-up process due to a variety of reasons [11].

Registration: Create an account on SoFi's platform by providing basic personal information and setting up login credentials. Typically, a significant drop-off occurs here, often due to complex forms or issues like invalid inputs. Drop-off rates can range from 30% to 50% [28].

Start: Begin the loan application process by selecting the desired loan type and providing initial financial details. Here, drop-off rates are 20% to 30%, as users start the application but may abandon it due to unclear instructions [29]

Submit: Complete the loan application form with detailed information and submit it for initial review. Here drop-off rates are 10% to 20%, as users are confused with required information [28].

Document Upload: Upload required documents, such as proof of income and identification, to support the loan application. This step can be cumbersome, leading to drop-off rates of 15% to 25%, especially if the process is not user-friendly or if users face technical issues [28].

Signing: Review anElectronic signing tends to have lower drop-off rates, around 5% to 15%, as users are generally committed by this stage as they electronically sign the loan agreement and other necessary legal documents [30].

Loan Funded: Once approved, receive the loan funds in your account, completing the acquisition process. Once all previous steps are completed, drop-off is minimal, typically less than 5%, as users are eager to receive the funds [31].

After calculating these probabilities, SoFi retains only 16% to 40% of its starting customers who reach the registration website. Due to the uncertainty of the customer acquisition process, SoFi first pursued a strategy of “expanding the top of the funnel”, meaning they aim to increase their client registration count, rather than decrease the uncertainty factor.

The form of customer acquisition can be separated into three categories: affiliates, employers, and person-to-person (P2P) lending [11].

Affiliates: As explained above, these are high-traffic sites such as Credit Karma or Lending Tree which provide advertising efforts for SoFi. Typically these firms use their platforms to communicate client information with SoFi. Then, SoFi uses this data in its instrumentation process to direct advertising to these potential clients.

Employers: SoFi partners with many firms so that they can offer HR benefit packages through SoFi. These partnerships can be split into associations that collect professionals such as the American Association of Doctors and Dentists, and then strategic partnerships that are involved in general business tasks. Examples of strategic partnerships include JetBlue and Alaska airlines which match half of an employee’s loans in airline credits. The reason for the split is that professional clients usually have a higher credit history due to their higher income.

P2P: Finally, SoFi takes part in P2P lending which consists of lending to members that are already part of the SoFi ecosystem. While there are 6mm SoFi members, this sector of customer acquisition is only 5% of total loans, which shows the importance of SoFi’s advertising efforts.

Marketing Stack & Pattern Payment Tracking

While the “expanding the top of the funnel” strategy worked well for SoFi for some time, they also began implementing initiatives to increase the retention of the customer acquisition funnel. SoFi describes this process as “making the funnel skinnier” [11].

SoFi’s first initiative in this process was implementing a manually trained model that analyzes compensation incentive requirements for affiliates. Essentially, if an affiliate helped acquire a customer, SoFi would pay them a percent of the customer’s acquisition cost (CAC).

While this distributed CAC to the affiliate used to be standardized with every client, SoFi’s new model made it variable, based on how much the affiliate helped to acquire the customer. This model is known as the “Multi-touch Attribution Model” (MTAM), as each customer acquisition channel gets a weighted average portion of the total CAC payment from SoFi.

SoFi used Google Analytics to implement MTAM, as it allowed them to visualize customer data through the marketing process. Additionally, Google Analytics has access to all of Google’s services, meaning SoFi gained access to many tools for data analysis.

However, this model had many issues, such as messy code analytics, poor accuracy across data silos, and limited reporting capabilities [11].

Messy analytics code: The Google Analytics platform had issues such as code redundancy, different file formats, and limited integration with different programming languages, which made data analysis difficult. This slowed down SoFi’s customer acquisition process and made the firm’s software developers complete menial data cleaning tasks.

Poor accuracy across data silos: 60% of the time SoFi’s user tracking service would not match up with the data set in the Google Analytics platform. The solution to this issue was that Google needed a sampling mechanism to refine the data and make sure it's correct, however, it was resource-intensive for SoFi to implement so they decided against it.

Limited reporting ability: As there are many different types of loans that SoFi offered and many channels to acquire these loans, it was hard for Google Analytics to find insight on specific transactions.

SoFi’s solution was a proprietary measurement system to provide stronger data analysis than Google Analytics. Additionally, the platform’s proprietary nature made it a lot safer from competitors and external actors who were attempting to steal from SoFi [11].

Overview: the goal of the measurement system was to create better data analysis for SoFi’s MTAM system. This allowed SoFi to track users through the custom acquisition funnel, so they could decrease drop-off rates.

Front end: The front end of SoFi’s system refers to the user interface that is accessed by clients. This system was made with Javascript. Javascript was the best language for the platform because it allows for continuous development from software engineers, and it makes software applications more responsive and user-friendly.

Back end: SoFi’s back end used a similar Javascript system, however, the programmed infrastructure was a lot more complex to provide insight into each application that was listed on the front end. The types of data collected in the back end are explained below.

In SoFi's system, data from the front end is sent to the back end using front-end pixels. These data points are categorized into page views, actions, and events [11].

Page views: capture details like screen resolution and the referring source when a user clicks a link and navigates to another page. Typically more page views for longer periods of time indicates customer interest.

Actions: are tied to page views and include user interactions like clicking a share button or entering text in a textbox. SoFi aims to lock in the customer after their first action by providing further advertising wherever the potential client has most of its actions.

Front/Back-end Events: are product-agnostic and pertain to various stages of the funnel, such as logging in, registering, or starting an application. The last steps of the marketing process which is explained as the “funnel” is the most integral to SoFi’s process as they are the closest to becoming clients.

Data Instrumentation

Finally, the data instrumentation process where SoFi implements prescriptive decisions based on its data analytics can be outlined in two processes: analytics and the advertisement orchestration engine (AOE).

Analytics include data that comes from affiliates and P2P marketing, and then “ingesting” the data into SoFi’s overall data measurement system [11].

Google Analytics & Amplitude: While historically Google analytics was the main tool for this process, due to past issues SoFi also began using the software Amplitude. Amplitude is a product analytics platform that allows SoFi to track customer engagement, and provides a more streamlined process, and friendlier interface than Google Analytics. SoFi uses these tools to visualize a big picture of how users interact with the applications.

Tableau: The data stored in Google Analytics and Amplitude is then sent into Tableau which is a data warehousing platform. Data warehouses are software platforms that focus on refining data for further use, similar firms that provide these services include Snowflake and Databricks.

After the data is uploaded and refined, it enters the AOE for SoFi to implement stronger advertising efforts [11].

MParticle: is a software platform that is centered around the real-time client profile. SoFi uses MParticle to understand client incentives, and direct advertising campaigns based on them. Previously, SoFi used platforms that collected user history or internet cookie data, however, this treated all of a client's devices as separate clients, even if they were used by the same user.

Redpoint Global: specializes in targeted emails, making it easy for SoFi to implement specific advertising campaigns to subsets of its customers. For example, if SoFi wanted to send an email to clients who made more than one hundred thousand dollars annually and had above a seven hundred fifty credits score, they could use this system.

Ad Insights: is a firm that helps SoFi with offline marketing. Ad Insights uses conversion logic, which allows the system to merge offline systems to online systems to allow SoFi to understand a customer’s offline and online journey. This is especially important for non-digital marketing such as newspapers or billboards.

As the data instrumentation process is complicated here is an example of a hypothetical customer “Ryan” who takes part in SoFi’s customer acquisition process [11].

Past historical data from Google Analytics and Amplitude is fed into SoFi’s AOE to prepare for the arrival of future clients such as Ryan. The data is then refined in Tableau and sent to the AOE.

Ryan enters the scene, and watches a SoFi advertisement on Instagram. This is immediately logged into the Amplitude and Google Analytics systems.

Next, Ryan logs into the SoFi website, but then leaves the website. MParticle receives this data and understands that it needs to stop advertising to Ryan, and focus on retaining him. Thus, MParticle sends a message to SoFi’s product team to reach out to Ryan to gain his interest in the system.

Then, Ryan gets persuaded by the product team, returns to the website and signs up for his first loan. MParticle recognizes a potential cross-selling opportunity, and begins advertising home/auto loans to Ryan.

Finally, Ad Insights and Redpoint Global helps SoFi with further email and offline advertising efforts. These new advertisements are built from insights from Ryan’s client information.

Section 3: Looking Ahead

Since the firm’s inception, SoFi has seen strong growth due to its product differentiation, strong customer acquisition strategy, and first-mover advantage. However to continue this growth, SoFi must pursue various opportunities, all of which may not pan out.

Opportunities

SoFi has various opportunities for future growth through continued horizontal product expansion, its new banking charter, brand recognition, student loan refinancing, and decentralized finance.

Horizontal Expansion: There are future product opportunities that SoFi could continue to pursue. Currently, SoFi is building a service that allows clients to take part in private investments in public equities (PIPE). As a first mover in this field, it would allow SoFi to access a new market and outpace competitors [9].

Banking Charter: In January 2022 SoFi received a banking charter, and then acquired Golden Pacific Banking Corp for $750mm, renaming the firm to “SoFi Bank”. With access to a charter, SoFi has lowered its cost of capital, as it is no longer reliant on other banks to hold its customer deposits. SoFi is now in a strong position to continue its growth prospects while also reinvesting in its core business [8][15].

Student Loan Refinancing: From March 2020 to September 2023 the Biden administration implemented a student loan moratorium which decreased the demand for student loans. While SoFi was hurt during this period, the moratorium has recently been lifted, and consequently, there has been an influx of student loan demand for SoFi to service [27].

Brand Recognition: As SoFi aims to become a “super app”, the firm must rapidly expand its influence to lock in brand awareness. As mentioned earlier, Noto has begun this process as SoFi announced a 20-year partnership with the LA Chargers for the naming rights of their stadium to “SoFi Stadium”. Additionally, SoFi has increased advertising, and took part in Reddit’s recent IPO, providing retail investors the opportunity to invest early, outpacing its competitors [9].

Decentralized Finance (DeFi): DeFi is the movement toward a financial system run by computers in a decentralized fashion, rather than centralized banks. The benefits to this system are security and efficiency, as wealth is less susceptible to theft, and is more liquid without a centralized arbitrator. SoFi has pursued this market with its $350mm investment into BlockFi which is a DeFi crypto trading platform. While the DeFi industry is young, it has lots of appeal in the fintech space which is a benefit to SoFi, as a first mover [9].

Challenges

Additionally, there will be many challenges to SoFi that will test its business model. Many of these risks include consumer pressure, poor acquisition integration, marketing expenses, and the advancement of competitors.

Consumer Pressure: With a more competitive credit market in 2024, and new lending products, SoFi’s early products may not seem as appealing to clients as they used to be. This could decrease the firm’s revenue, and contract its margins [15].

Poor Acquisition Integration: Since SoFi’s inception, the firm has executed six acquisitions, with inorganic growth being a pivotal part of SoFi’s growth. There could be a potential issue where SoFi acquires companies faster than they can be integrated. Unchecked inorganic growth could lead to a situation such as Yahoo and Tumblr, where the firm spent $1.3bn to acquire Tumblr and was forced to write down the firm’s valuation post-acquisition.

Marketing Expenses: Currently, 20% of SoFi’s revenue is spent on marketing expenses, and these expenses will only grow as the firm updates its customer acquisition strategy, As SoFi is already operating at a loss, this could deplete the firm’s cash flow in the future, and force it to raise debt or dilute shareholders for financing [15].

User Interface Weakness: While SoFi outpaces its competitors on the backend in advertising and enterprise AI, SoFi falls behind in its user interface. Notably, Robinhood has performed especially well, introducing the same trading opportunities and services as SoFi, while presenting a more friendly user experience. If SoFi can’t update its front end fast enough, clients may leave to its competitors.

Commoditization of Galileo: Currently, Galileo is the industry standard for back end data analytics for most digital banks and fintech firms. However, many larger firms in the data analytics space such as AWS and Microsoft Azure have grown interested in the space and have begun developing their own platforms. If those platforms advance their capabilities, SoFi may lose its backend competitive advantage and fall behind competitors [9].

Lessons Learned

The journey of SoFi provides a variety of knowledge for investors and business leaders who are interested in the fintech sector.

SoFi is a great example of how strong leadership is essential to the growth of a business. Anthony Noto joined SoFi when the firm had a “frat house” culture, and a 2.9 rating on the Apple Store. With the help of Noto, SoFi has been lifted out of its trough and outperformed competitors.

Additionally, SoFi is an industry disruptor that provided needed changes to the legacy infrastructure in the banking industry. While the old guard of financial services controlled many clients, SoFi used its asset-light model to quickly penetrate the fintech market and undercut its competitors. This strategy was implemented through expansion and customer acquisition.

Finally, SoFi is an important example of understanding the changes in a sector and capitalizing on them. More specifically, SoFi’s Galileo was extremely successful. Although the firm had a high price tag of $1.2bn, it allowed SoFi to monopolize the enterprise AI market in fintech.

SoFi is first and foremost an example of industry disruption through technology. The legacy providers of financial services had used inefficient technology for decades, which gave SoFi a great opportunity to expand.

While the firm’s beginnings started with little digital infrastructure and instead relied on its belief in the credit worthiness of students, it displayed a lack of development in traditional lending. Through pinpointing specific clients such as doctors or lawyers SoFi tailored its lending services and undercut competitors.

SoFi also outpaced its peers in utilizing data for customer acquisition. In particular, the firm’s realization of how multiple affiliates can help in the customer acquisition process, allowed them to expand marketing capabilities, and efficiently target customers.

In 2020, the acquisition of Galileo provided SoFi with a new enterprise AI software to not only optimize its operations but also to control the supply chain of competitors. SoFi’s foresight of the importance of AI in financial services allowed it to stay ahead of the tide and disrupt its peers.

Finally, SoFi is a story of exceptional execution. With the help of Anthony Noto, SoFi has grown with the aim of reaching “super app” status through vertical and horizontal expansion.

Noto’s initiative to horizontally expand SoFi was the driving force of the firm’s new products such as SoFi Credit Card, SoFi Home Loans, SoFi Protect, and Lantern by SoFi. These products provided new use cases for potential clients, but also provided cross selling opportunities for existing clients.

Additionally, SoFi had a strong drive for vertical expansion, especially in customer acquisition and data analytics. SoFi’s switch from Google Analytics to a proprietary measurement model, allowed SoFi to exponentially develop the strength of its existing products.

Finally, Noto’s understanding of brand strength allowed SoFi to strengthen its client retention and was also appealing to flocks of new customers. In particular the firm’s deal for SoFi Stadium, and work with the Reddit IPO may seem unconventional, but it has been a significant contributor to SoFi’s performance.

Many startups are successful due to being the first mover in their industries. However, it's important to not fall asleep at the wheel by continuing to disrupt the sector and execute strategic decisions at the management level. While SoFi has successfully executed this path, there are new challenges on the horizon, and only time will tell if SoFi’s value proposition will hold.

[1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15] [16] [17] [18] [19] [20] [21] [22] [23] [24] [25] [26] [27] [28] [29] [30] [31]

Interested in our updated reading / wellness list? Check it out here.

How did you like this week’s Pari Passu? Loved | Great | Good | Meh | Bad

Interested in our IB / PE / HF course recommendation? Check it out here.