Welcome to the 91st Pari Passu Newsletter.

Today, I have a lighter writeup for two reasons:

I sincerely hope most of you are not in the office; if you are, I would encourage you to skim this email and try to leave early to enjoy a nice summer Friday evening. We have many cold weeks ahead when we will dive into complex topics!

Over the past few weeks, we have had some complex write-ups. I would read again and truly master the below writeups in order to get the most out of next writeup (will be one of the most exciting writeups of the year):

Let’s go back to today’s edition. In this year’s Norges Bank Investment Management Investment Conference, the world’s top financial professionals shared their ideas and knowledge about a simple topic: how to become a better investor. Today, we will explore some of the key insights and takeaways from the conference.

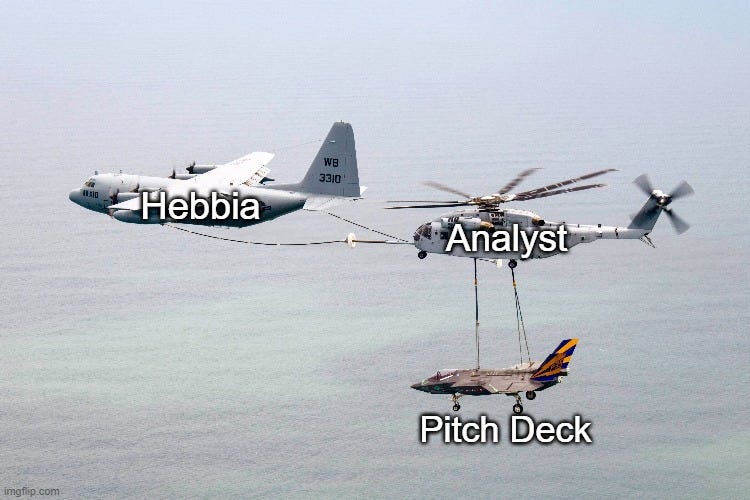

Curious how the world’s best investors are using AI

Hebbia works with lean leading credit and restructuring shops.

Hebbia can summarize a credit agreement, draft one-pagers based on your team’s investment philosophy and so much more.

Book a 20 minute demo to see why they work with 1/3 of the 25 largest alternative asset managers.

What is a good investor?

Here are some ideas, per members of Norges Bank Investment Management’s portfolio teams:

A good investor combines passionate curiosity with the relentless pursuit of truth

A good investor truly understands the market and their portfolio, how to enter and exit positions, and how to effectively manage risk

A good investor is confident enough in their conviction and is able to make contrarian bets that may disagree with the consensus

Each of these perspectives provide valid, broad-level descriptions of what makes a good investor. Being a good investor means a lot of different things, and developing a perfect definition of a “good investor” is quite difficult. However, a two attributes shared among all high performing investors: adherence to a developed philosophy and mastery of risk management.

Philosophy

Every high performing investor has a thorough and developed investment philosophy for which they base their decisions upon. At Bridgewater Associates, per CIO Greg Jensen, this philosophy consists of three main parts: fundamental, systematic, and diversified. ‘Fundamental’ refers to an understanding of the true drivers of the market; ‘systematic’ refers to the application of the fundamental understanding to develop explicit rules to be debated and tested; ‘diversified’ refers to a strategy to hedge against being wrong – in Bridgewater’s case, portfolio diversification is their method of balancing risk.

Developing a sound investment philosophy ensures that investors make rational, consistent decisions on the market. Furthermore, it allows investors to make unbiased decisions that are unaffected by short-term influences such as emotional and mental states. Howard Marks, founder and CEO of Oaktree Capital Management, calls on investors to develop a unique investment creed. Despite the different terminology, his ideology is very much similar to that of Jensen’s. The first step, Howard Marks states, is to decide whether one wants to be average or to be above average, where striving to be above average forces one to take on the risk of being below average. In other words, Howard Marks believes that all investors should develop their own definition of success and outline the risks that they are willing to take to achieve it. Being above average in investing is very difficult, but those who are able to forge a sound investment philosophy, over years of experience and compounded learning, will be the ones that come out on top.

Risk Management

Good investors have accepted that it is difficult to have both superior returns and a high level of safety. Howard Marks defines market risk as the risk of bad outcomes, as opposed to the commonly accepted definition of risk as the variability of outcomes. Naturally, risk and return are positively correlated, and as risk increases, the range of possible outcomes increases, and the unfavorable outcomes become worse. Developing effective strategies to generate high returns while mitigating the adverse effects of risk is what differentiates average from above average performers.

For Jensen, diversification is key to risk management. Jensen defines diversification as aiming for fifteen to twenty uncorrelated return streams. Uncorrelated means that changes within one return stream do not affect the other return streams. Furthermore, Jensen states that real diversification requires thinking in terms of risk rather than capital. For example, an investor could allocate capital equally between public equities and government bonds, but risk has not been allocated equally because public equities are inherently much riskier than bonds are. Risk must be equally allocated across return streams and asset classes to ensure effective diversification.

What makes a good investment organization?

We are often a product of our environment, and high performing investment organizations can foster meaningful growth to transform good investors into great ones. Robert Wallace, CEO of the Stanford Management Company, which manages Stanford University’s ~$40bn endowment, outlined the three pillars of investment success at his organization.

The first pillar is strategy. Famous Norwegian explorer Roald Amundsen said “Victory awaits him who has everything in order – people call it luck.” True success is rarely the product of luck, but the product of thorough preparation and strategy. Therefore, Wallace employs a specific strategy to achieve their two goals: provide reliable support for Stanford University’s operating budget and preserve the purchasing power of the endowment for future generations by offsetting the annual operating budget payout and higher education inflation. The endowment portfolio maintains an equity bias (~70%), due to their higher expected return than bonds and cash. Diversification is a key aspect of the portfolio, with Wallace referring to it as the only “free lunch” in investing. Portfolio equities are diversified across region, industry, public/private, etc., in order to lower the risk of permanent capital loss and volatility. The remainder of capital is invested in fixed income and absolute return for further diversification.

The second pillar is execution. A strategy might look good on paper, but it is useless without proper execution. At the Stanford Management Company, this entails three aspects. Firstly, associates perform rebalancing between asset classes to preserve the desired risk, return, and liquidity characteristics. Next, associates rotate capital within asset classes depending on the opportunity sets available in each asset class. Lastly, the company handpicks partners to manage each of their asset classes. The practice of outsourcing asset managers to third party, usually boutique, firms is common among endowment management companies, and superior manager selection is paramount to portfolio success. The key characteristics that Wallace looks for in a manager are rigorous investment discipline, repeatable and thorough process, superior judgment of risk and return, an appropriate capital base, and a strong economic alignment of interests.